Driving Consistent Growth

Delivering Sustainable Value

A Proven Financial Track Record

43.01%

Efficient capital deployment; superior returns.

#2 in India

Second-largest selling wood adhesive brand in the retail segment.

Net-Debt-Free

Robust balance sheet with zero net debt.

90% Dividend Declared

Consistent shareholder payouts.

Start a new journey!

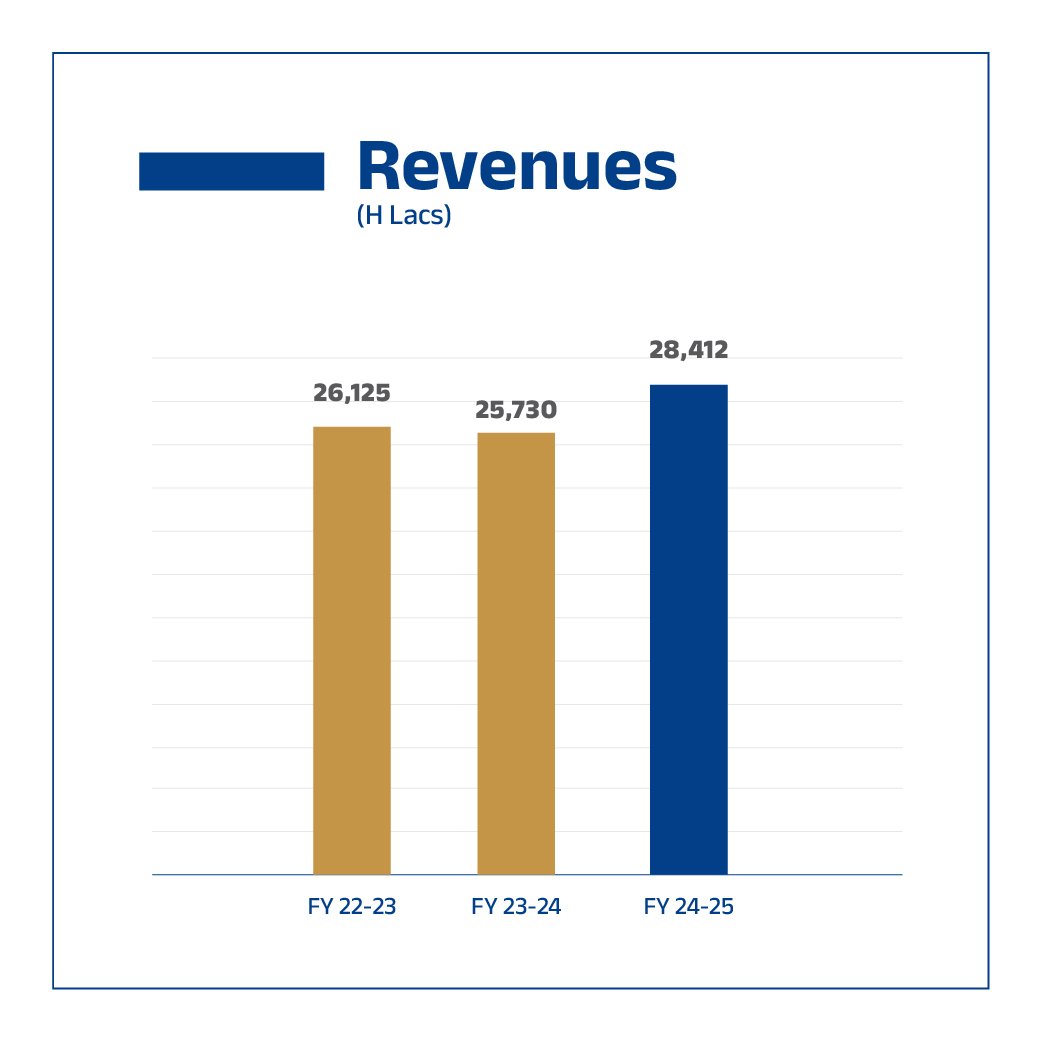

Revenues

Consistent topline growth, driven by an expanding customer base and sustained demand for our premium wood adhesives. Ongoing innovation and focused market expansion continue to propel performance.

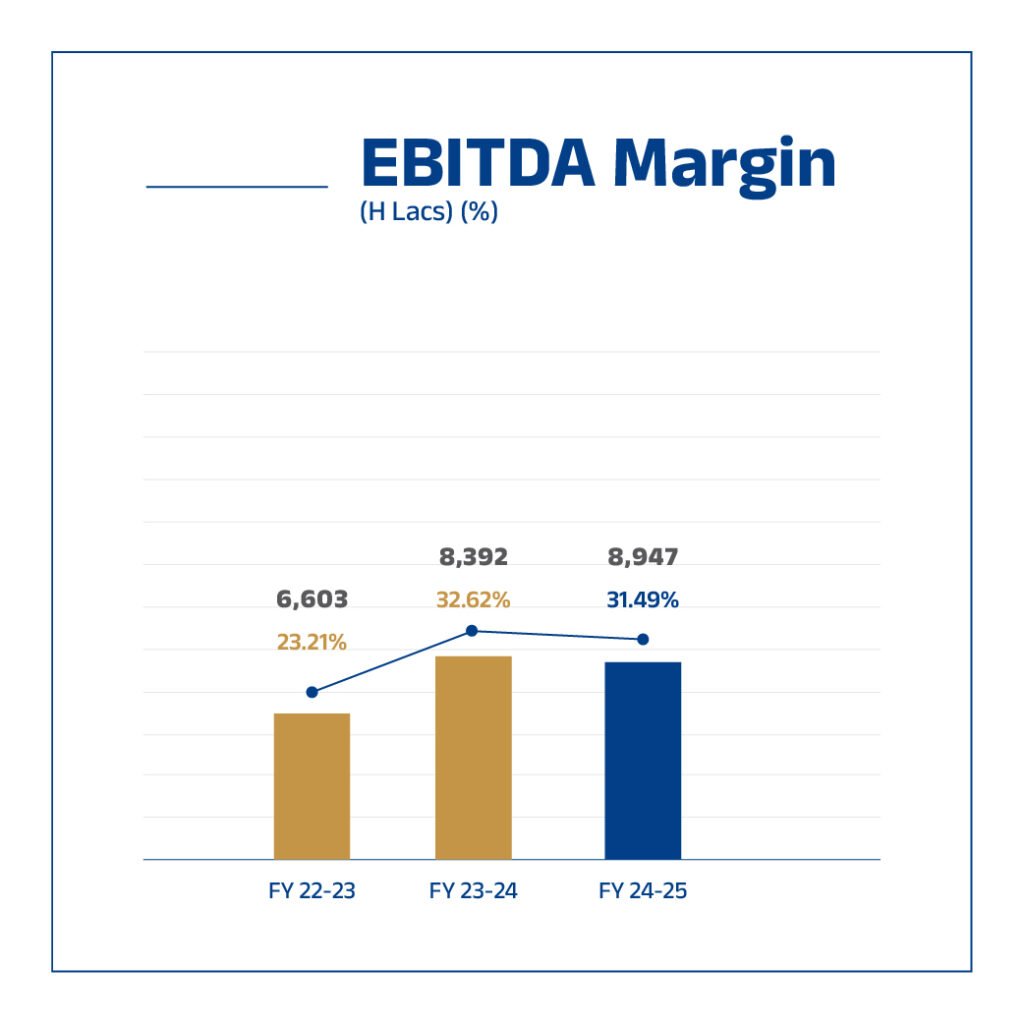

EBDITA MARGINS

Expanding margins driven by operational efficiency, disciplined cost control, and a stronger product mix, reinforcing earnings quality.

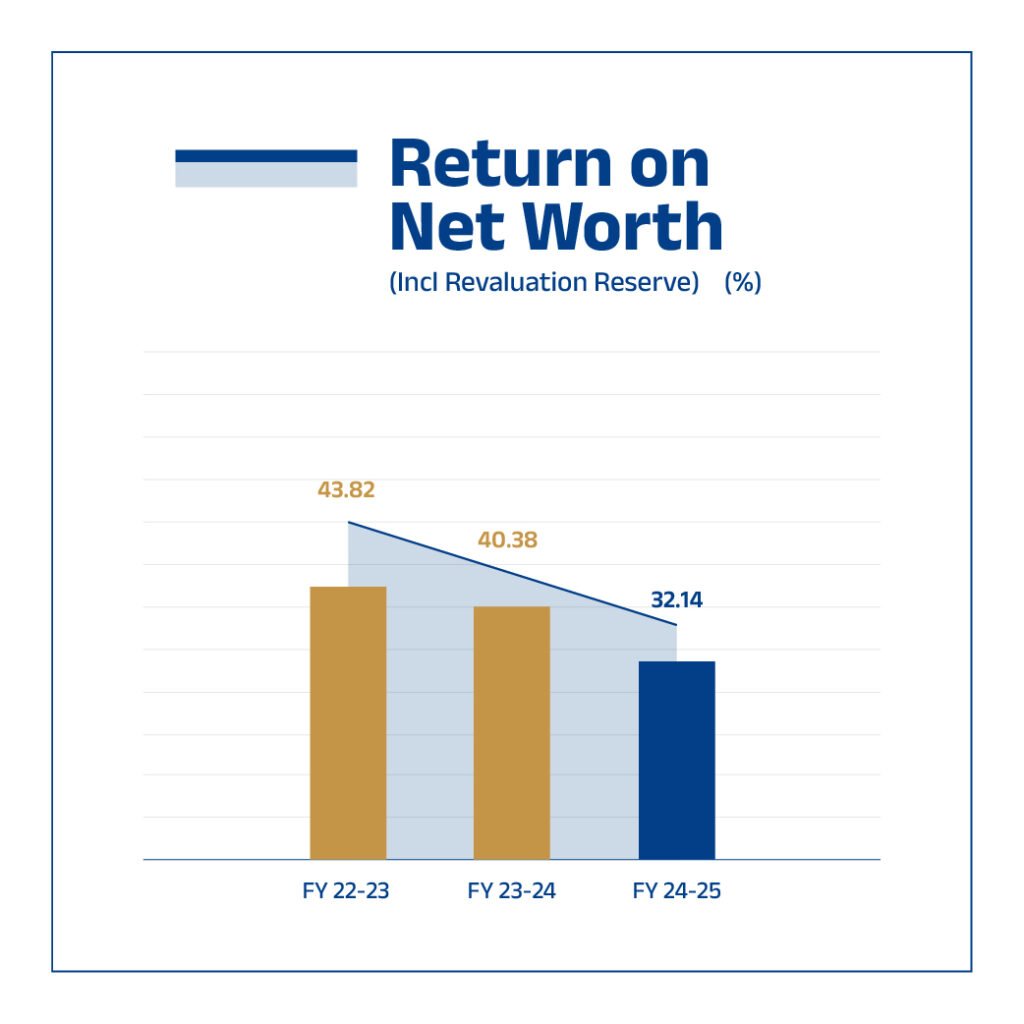

Net Worth

Steady growth driven by strong retained earnings and disciplined reinvestment—reinforcing balance-sheet strength and funding future expansion.

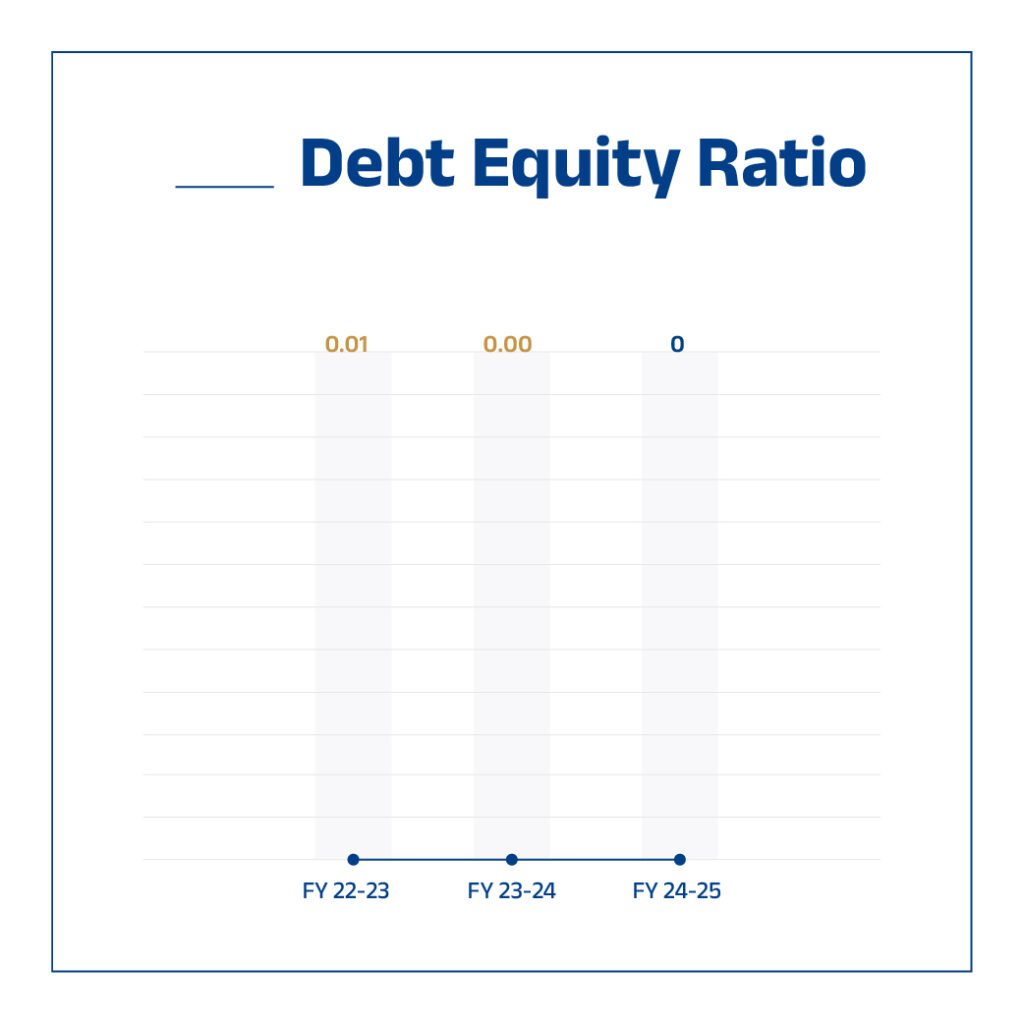

Debt-Equity Ratio

Maintaining a near-zero ratio strengthens liquidity and cushions macro shocks. It ensures growth is funded on solid fundamentals, not dependence on debt.

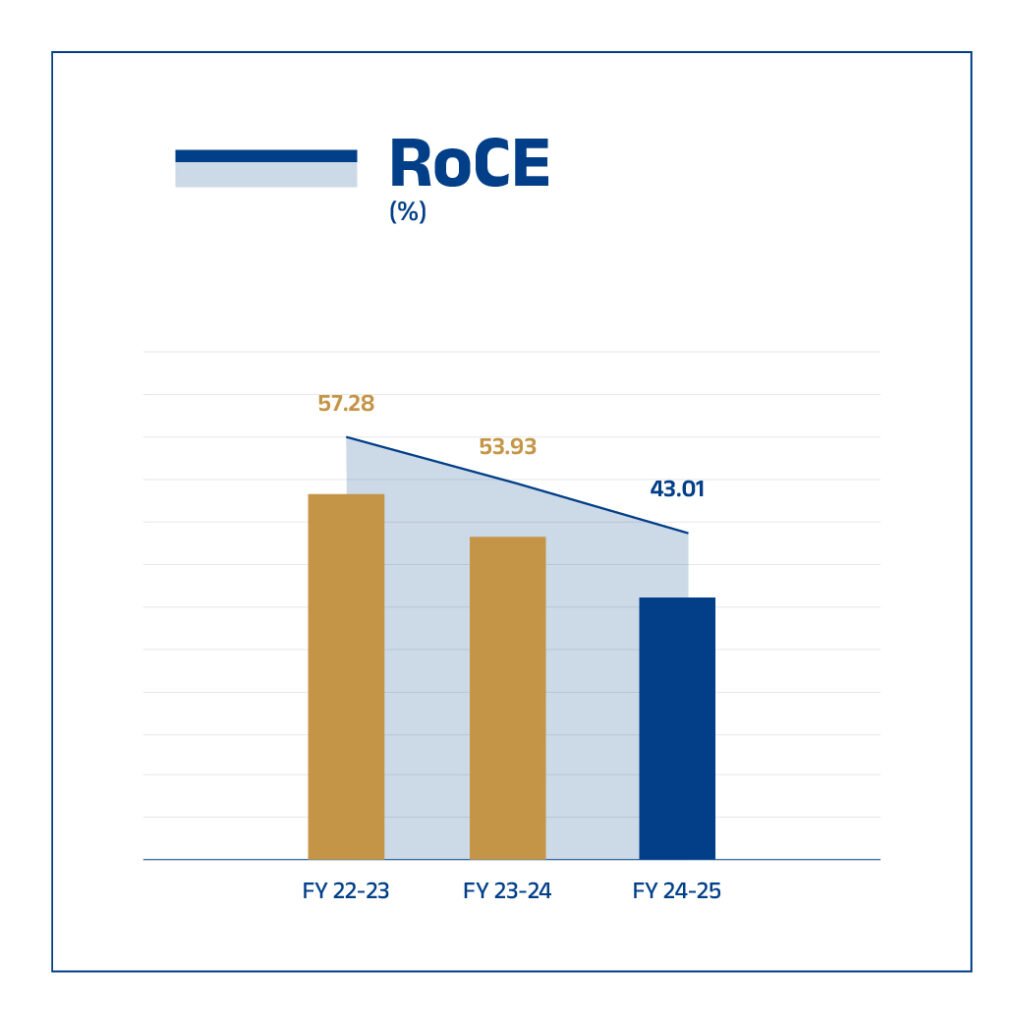

Return on Capital Employed (RoCE)

With ROCE above 43%, EURO Adhesive is converting capital into returns efficiently. It reflects disciplined allocation, strong execution, and the agility to adapt to shifting market dynamics.

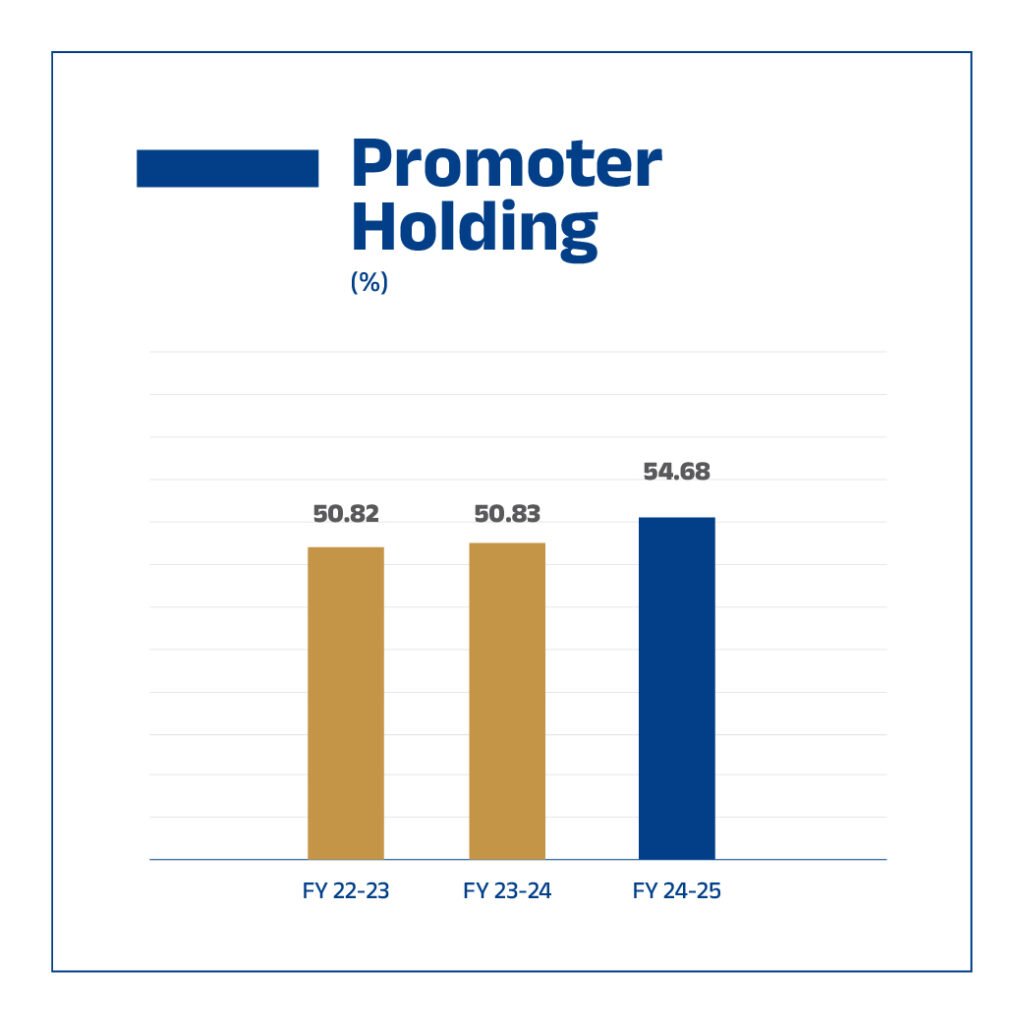

Promoter Holding

Promoter stake remains strong and is rising, signaling long-term commitment and confidence. It stood at 50.82% in FY 22-23 and 50.83% in FY 23-24, and is projected to reach 54.68% in FY 24-25, underscoring alignment with shareholders and conviction in our business strategy.

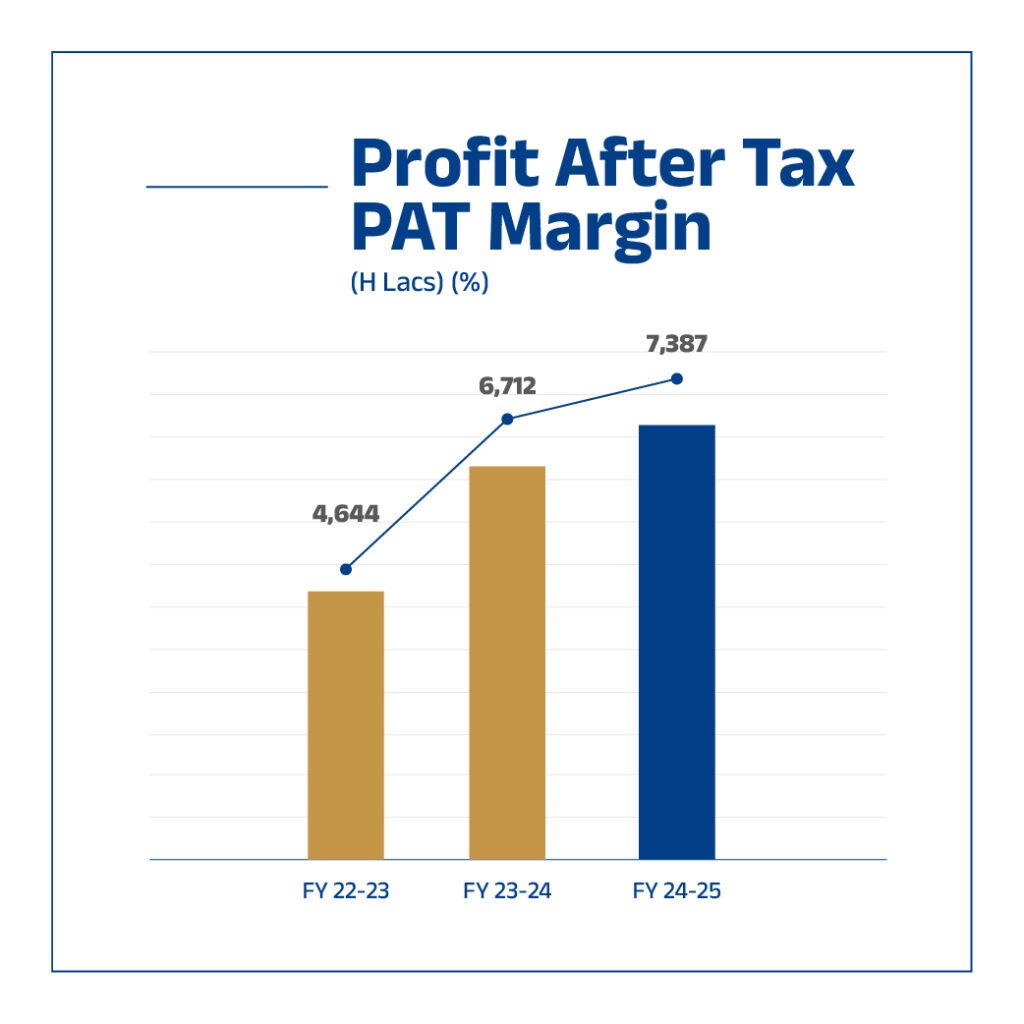

Profit After Tax (PAT) Margin

Healthy expansion driven by operational efficiency and improved mix. PAT rose from ₹4,644 lakh in FY22–23 to ₹6,712 lakh in FY23–24, and is projected at ₹7,387 lakh in FY24–25—signaling stronger earnings quality and enhanced shareholder value.